スイシン ポルテクス is a platform designed to simplify cryptocurrency trading. It blends artificial intelligence with real-time data to guide users through the crypto market. Whatever is to be traded, スイシン ポルテクス provides tools to make it easier. The platform examines trends and automates tasks to save time. Security comes first, and funds and information are safe.

For beginner traders, スイシン ポルテクス makes the fundamentals easy. Experienced traders can enjoy sophisticated features such as automation and in-depth analysis. Small investors can work to build incrementally, and large investors can optimize strategies. It is more than trading; it allows traders to understand the market and make choices.

スイシン ポルテクス focuses on making crypto trading straightforward for all. スイシン ポルテクス cuts through market clutter to deliver helpful solutions. With AI, スイシン ポルテクス brings clarity to a fast-paced world. The platform helps users spot and capitalize on opportunities. スイシン ポルテクス believes technology can improve trading, making it safer and simpler.

スイシン ポルテクス is a platform for cryptocurrency trading powered and enhanced by AI. It operates 24/7, ensuring that opportunities are not missed while employing machine learning capabilities to aid decision-making. スイシン ポルテクス offers secure and automated tools. Traders of all levels are encouraged to explore the system while remaining cautious, as the crypto market is highly volatile.

No platform in the crypto space can tame the wild nature of the market. However, traders can make smarter and more informed decisions with access to suitable tools. スイシン ポルテクス fuses professional experience with AI analysis to facilitate crypto trading. Register on スイシン ポルテクス to get started.

スイシン ポルテクス makes the sign-up process as easy as can be. Registration is quick, requiring only familiar details. Once these details are confirmed, users gain access to the platform and its tools, granting them access to explore automated trading features and make informed financial decisions.

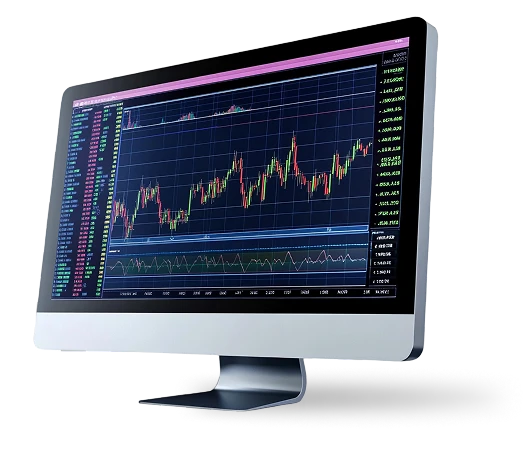

The crypto market is an unpredictable, non-stop market operating 24/7. スイシン ポルテクス seizes this opportunity and uses AI bots to monitor changes in the market around the clock, informing its users. Traders need this as they don't have to sit and monitor the market every time.

スイシン ポルテクス has an AI-powered bot that scans the market with precision and carries out its trades based on the information obtained. Although no feature can guarantee favorable outcomes every single time, this feature assists those who have demanding schedules. Give スイシン ポルテクス a shot and access this.

The machine learning capabilities of the スイシン ポルテクス platform quickly identify patterns and adapt strategies for traders. This strengthens market understanding for users of all levels. A market as unpredictable as the crypto market needs an ever-evolving approach. Get started with スイシン ポルテクス to explore this.

スイシン ポルテクス offers live insights into the market. It filters out excess and unnecessary information to give traders clarity in the market, allowing them to participate with up-to-date information and relevant data. Although external influences will always be present, informed analysis can guide strategies. Register with スイシン ポルテクス to access help for shifting market conditions.

スイシン ポルテクス understands that crypto wallets are necessary for holding, managing, and securing digital assets. Hot wallets provide users with quick accessibility, while cold wallets ensure added protection of said assets. Hot and cold wallets are used in trading, depending on the trading approach a user favors.

Hot wallets are used when there is a need for instant access or speed online while trading. Cold wallets offer security, safeguarding assets offline. Both wallets serve different purposes: one for convenience and speed, the other for security. Mastering how and when to use both can facilitate asset management amid such an evolving market.

The use of backups, authentication, and encryption as layers of security is essential for protecting digital assets from theft or getting lost. While these layers of security significantly reduce the risk of unauthorized access, no security protocols can eliminate risks because cyber security threats are also evolving.

Phishing scams target wallet credentials using deceptive means to steal assets. Anyone with a crypto wallet should avoid exposing wallet keys or details to suspicious individuals, websites, or platforms. To spot phishing scams, remain cautious and vigilant at all times.

Multi-signature wallets require authorization from multiple signatories before a transaction can be executed. Multiple parties can manage joint funds this way, and this protocol reduces the likelihood of unauthorized transfers, hence improving asset protection measures.

Decentralized exchanges bypass third parties to allow users to swap or trade their cryptocurrencies directly in the blockchain network. Unlike centralized (governed) solutions, these decentralized exchanges give users full control of their digital assets. Grasping how DEX functions aids in navigating their setup.

DEXs carry out operations through liquidity pools funded by their users. These liquidity pools enable automated swapping of several crypto pairs, cutting out the middleman every time. Fees reward pool funders, but market fluctuations can affect returns over time. Knowing how to swap crypto pairs is important.

A digital wallet is required when using a DEX; this enables direct access to blockchains, interacting with every transaction. Users self-execute transactions, ensuring complete ownership of assets. This liberty demands responsibility from users, as errors can lead to permanent loss of funds.

AI can be used to interpret social media analysis and news to understand the daily mood of the market. Positive news may indicate a bullish market, while negative buzz may trigger a bearish market. This analysis offers users extra information and additional tools for analyzing market conditions to aid decision-making. スイシン ポルテクス provides this feature at no extra cost.

AI systems process large amounts of data. They track shifts in market sentiments, which can potentially impact asset performance. However, this process may not be fail-safe, as several external factors drive the market's volatility. Understanding market sentiments can alert users to refine strategic approaches. Thus, traders can cover more bases. Sign up with スイシン ポルテクス to get started.

Social media posts on platforms like Twitter can influence crypto prices daily. Viral hype can spike demands, while uncertainty can trigger traders to sell off the asset. Tracking these signals provides traders with daily insights into the market state; however, sudden shifts remain a risk in the crypto space, so it is advisable to cross-check multiple factors.

News events such as regulatory changes or hacks move the crypto market in seconds. Positive updates drive the markets to make highs, while scandals or setbacks sink them. Monitoring the news allows traders to anticipate shifts in the market and adjust trades, although sudden volatility can outpace market réaction.

AI-generated signals can alert users when there is a sudden change in the market mood. This helps traders stay up-to-date and adapt to trends by analyzing real-time discussions and activity. By interpreting these signals alongside other information gathered from the market, traders can make informed decisions.

AI-generated signals can alert users when there is a sudden change in the market mood. This helps traders stay up-to-date and adapt to trends by analyzing real-time discussions and activity. By interpreting these signals alongside other information gathered from the market, traders can make informed decisions.

Earning rewards by locking digital assets in liquidity pools is called yield farming. It involves automated smart contracts and attracts traders seeking potential earnings from liquidity contributions. Variation and volatility of interest rates affect gains over time. This method of earning has its appeal and risks.

Decentralized platforms like Uniswap are funded every day by farmers. These cryptoheads aim to gain a portion of the trading fees daily. Market stability may enhance potential rewards, while dips in the market can pose challenges. Careful assessment of the market and extreme caution are required when venturing into yield farming.

Farmers often switch pools strategically to participate actively. Although crypto holders can easily get into yield farming, doing well in this space could depend on adequate market knowledge. Gains may be tempting, but understanding how the system works is necessary to make informed decisions and avoid setbacks. Access the needed insights on スイシン ポルテクス.

DEX trading is powered by liquidity pools. They hold token pairs to facilitate seamless swaps. Users fund these pools and earn fees when trades are made. These swaps are done without the need for a middleman. Some platforms offer access to dynamic pricing models that adjust rewards based on market demand and liquidity depth. Protocols with advanced pooling structures allow cross-asset swaps on multiple token pairs.

Pools operate using automated market makers (AMM). These set token prices are based on the algorithm. This is done to do away with the need to use centralized order books. Participants stake crypto and may get fees proportional to their share of the pool. Some protocols use different fee structures to foster more liquidity when the market dips. This approach ensures dynamic earning opportunities for liquidity providers.

Contributing to liquidity pools has risks. If the value of a token declines before withdrawal, it could lead to a loss of funds. This is why platforms such as Binance employ customized asset ratios to diversify. Other platforms may reward users for their prolonged participation. The longer one participates, the more liquidity incentives one can access. Traders should be sure to choose the most favorable protocols for them. Gain more insights into liquidity pool incentives by using スイシン ポルテクス.

Crypto staking is a process where assets are locked for transaction validation in blockchain networks. Traditional mining methods have been replaced by proof of stake (PoS) to reduce the high energy consumption associated with crypto mining. Blockchain transaction validators receive rewards proportional to their stakes. Most networks implement penalties for suspicious activity, thus fostering security. Use スイシン ポルテクス to explore the role of staking in crypto.

Blockchain networks such as Ethereum consistently use staking to secure transactions via locked crypto stakes each day. Participants earn tokens to help validate blocks and run special nodes. Some platforms use different staking rates based on the level of participation by a user. This, in turn, varies the possible reward. Register with スイシン ポルテクス to dive into the pros of staking. Learning its mechanics shows why many choose it amid Crypto’s fast-paced market.

Traders commit crypto to nodes aiding blockchain consensus for rewards. These staked crypto are inaccessible for the entire duration of their lock-up. Adaptive withdrawal methods of staked crypto come at a penalty but ensure faster withdrawal. Multi-layer staking is also a practice. It involves the diversification of validator roles across network security functions. Understanding these differences in staking methods informs one’s financial decisions.

Scalability defines how fast blockchains handle transaction volumes. Slow networks delay moves, and volatility adds pressure. Bitcoin and Ethereum have faced scaling issues, resulting in high fees and network congestion. In recent years, various solutions have come up to address this. These include sharding and the integration of side chains.

The speed of a blockchain and its scalability depend on several factors, such as its block size, network structure, and consensus mechanisms. Layer 1 solutions enhance the base performance of protocols. Similarly, L-2 solutions ensure improved outputs by processing selected transactions off-chain.

Block size, confirmation time, and consensus protocols determine the speed of transactions on the network. Larger blocks speed up trades, but this takes a toll on the nodes over time. Smaller ones lag when there is a lot of traffic. This is why some networks use adaptive block sizes to tackle traffic demands by adjusting capacity.

Blockchains can get congested when network activity goes up, slowing transaction confirmation. This happens when trading demands exceed the processing capabilities of the network. Gas fees fluctuate in blockchains like Ethereum based on traffic and network activity. Strategies such as priority bidding allow faster execution.

L-2 solutions were introduced to enhance and upgrade scalability. They involve processing transactions externally before finishing them on the main network. Rollups reduce the computational load by grouping transactions into batches. Plasma chains offer separate execution layers, not compromising security and optimizing the performance of the blockchain.

Scalability balancing requires speed, décentralisation, and security. Faster networks process more transactions but may reduce validation participation, while decentralized systems distribute control among more nodes, which can lead to longer processing times.

スイシン ポルテクスs automation simplifies trading by integrating AI for strategic execution. This technology aids informed decisions, offering structured assistance in crypto markets. However, disciplined use is essential, as market volatility affects outcomes. No tool guarantees success in this unpredictable space.

スイシン ポルテクス enhances trading by offering AI-driven insights, supporting users of all experience levels. It serves as a foundation for objective decision-making. Automated trading is very much necessary, given crypto’s vastness and volatility. Access this and more on スイシン ポルテクス.

| 🤖 Registration Cost | Free of Charge |

| 💰 Financial Charges | No Additional Charges |

| 📋 Registration | Quick and Straightforward Process |

| 📊 Education Opportunities | Crypto, Mutual Funds, Forex, Stocks |

| 🌎 Supported Countries | Available Worldwide, Excluding the USA |